CERTIFIED EXIT PLANNING ADVISOR

CREDENTIALING PROGRAM

Become the Most Valued Advisor

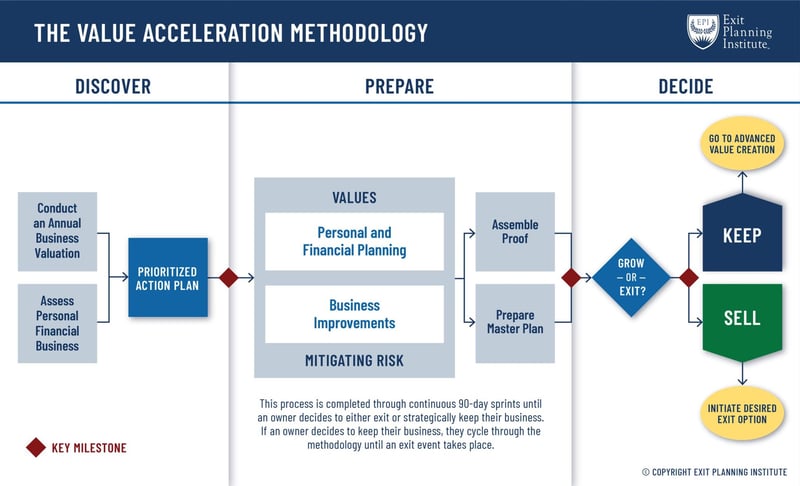

The Certified Exit Planning Advisor (CEPA®) credential is for professional advisors who want to effectively engage more business owners. Through the process of Exit Planning (the Value Acceleration Methodology™), owners can build more valuable companies, have stronger personal financial plans, and align their personal goals. Earning CEPA doesn't change your expertise, it enhances your ability to engage business owners and have value-added conversations around growth and exit.

Earning CEPA is for those who want to:

WHAT'S THE TIMELINE FOR CEPA?

Download the “CEPA Checklist: 3 Easy Steps to Become Certified”

"If you want to work with business owners, the CEPA credential is essential."

The CEPA credential is one of the most valuable and useful designations I have in working with business owners. It gave me a knowledge base, vocabulary and process to speak with any Business Owner with confidence. If you want to work with business owners, the CEPA credential is essential.”

Charles M. Jarrett

CFP®, CPWATM, CEPA®, CIMA®, ChFC, CLU, CRPC®

Private Wealth Advisor at Merrill Lynch Private Bank & Investment Group Senior Vice President

"I have worked to integrate different CEPA principles into my own company that have helped to move the needle internally. I have also worked to expand my network of professionals to team up with and refer with in the future. The CEPA is a differentiator for me in my area of practice, which has already opened up some new opportunities."

Matthew R. Barrette

Senior Financial Consultant at Market Square Advisors

"An instrumental tool I use when working with business owners."

The CEPA program continues to be an instrumental tool I use when working with business owners. It has been an honor to educate as a faculty member and meet the new CEPA graduates. Our advisors continue to integrate the foundation of the Exit Planning Institute into our conversations with clients.

Justin Goodbread

CFP®, CEPA®, CVGA®

CSO of WealthSource Partners, LLC.

"Intuitive, concise, and helpful."

As a former institutional investor and equity research analyst, I found the Value Acceleration Methodology intuitive, concise, and helpful. It is a great distillation of value enhancers for almost any business. What I took the most out of though, was the team nature of providing services and how to best help on the personal side.

Erin Niehause

CEPA®, CFP®

Vice President, Private Banking JPMorgan

"Useful and engaging"

The CEPA credentialing program is by far the most useful and engaging content I’ve studied of any credential.

Michael Sheppard

CFP®, CPFA, CEPA®

Group Vice President at Thrivent

"The best exit planning credential out there"

This is the best exit planning credential out there. You get a great education through the class and you get continued support from the staff and the network that you get to know through the program.

Brett Spencer

MS, CFP, CEPA®

Financial Advisor at Impact Financial

"CEPA gave me a better vocabulary to use with business owners"

I have been doing exit planning since 2006 but did not call it Exit Planning at the time. CEPA gave me a better vocabulary to use with Business Owners to have more in-depth conversations. It also gave me a framework and process to talk through with Owners. My conversations went from messy to more succinct by going through the CEPA program.

Andrew "Drew" McLaughlin

Financial Advisor at UBS Private Wealth Management

"I went through the CEPA program to better educate myself on how to better invest in my company. In doing so, I've been able to not only increase the value of my company, but spread the wealth of knowledge to other small business owners in starting a new practice. This program helps owners uncover so many blind spots they don't even realize they have!"

Kiley Peters

CEPA®, Founder & CEO of Braindchild Studios and Founder of RAYNE IX

"I am fully embracing the CEPA credential into my practice. It has opened up new connections all over the United States."

Linda Ruffenach

CEPA®, Founder, Chief Strategist, and Business Coach at Execuity LLC

“For any CPA considering this, my comment to them would be that above all of the things that CPA’s do for their clients, nothing is more important than exit planning. A successful exit is the ultimate service a CPA can help provide to their clients..”

Bill Kenedy

CPA/ABV, CFF, CEPA®

Partner at Lutz & Company PC

CEPA Registration Includes

Continuing Education Credits: The CEPA program is approved for up to 19 CPE hours and 14 CFP® hours.

5-Day CEPA Credentialing Program experience

Program manual including presentations and exercises

Pre-CEPA onboarding session with Member Experience team

Faculty Q&A and networking sessions

CEPA examination fee

Beyond CEPA implementation session

1-Year of Credentialed Plus Membership

Walking to Destiny: 11 Actions An Owner MUST Take To Rapidly Grow Value & Unlock Wealth (Book)

HAVE QUESTIONS ABOUT CEPA?

Give us a call! Our team is here to answer your questions and

help you determine if CEPA is the right fit for you and your practice.

Value Acceleration Methodology™

Want to get ahead on your pre-reading? Download the Perfect Exit chapter and case study below.