OUR METHODOLOGY

True holistic exit planning aligns the personal, business, and financial goals of the business owner, equipping them to leverage the most out of their most valuable asset: their business. Learn the Value Acceleration Methodology™, the foundational framework that exit planning is built on.

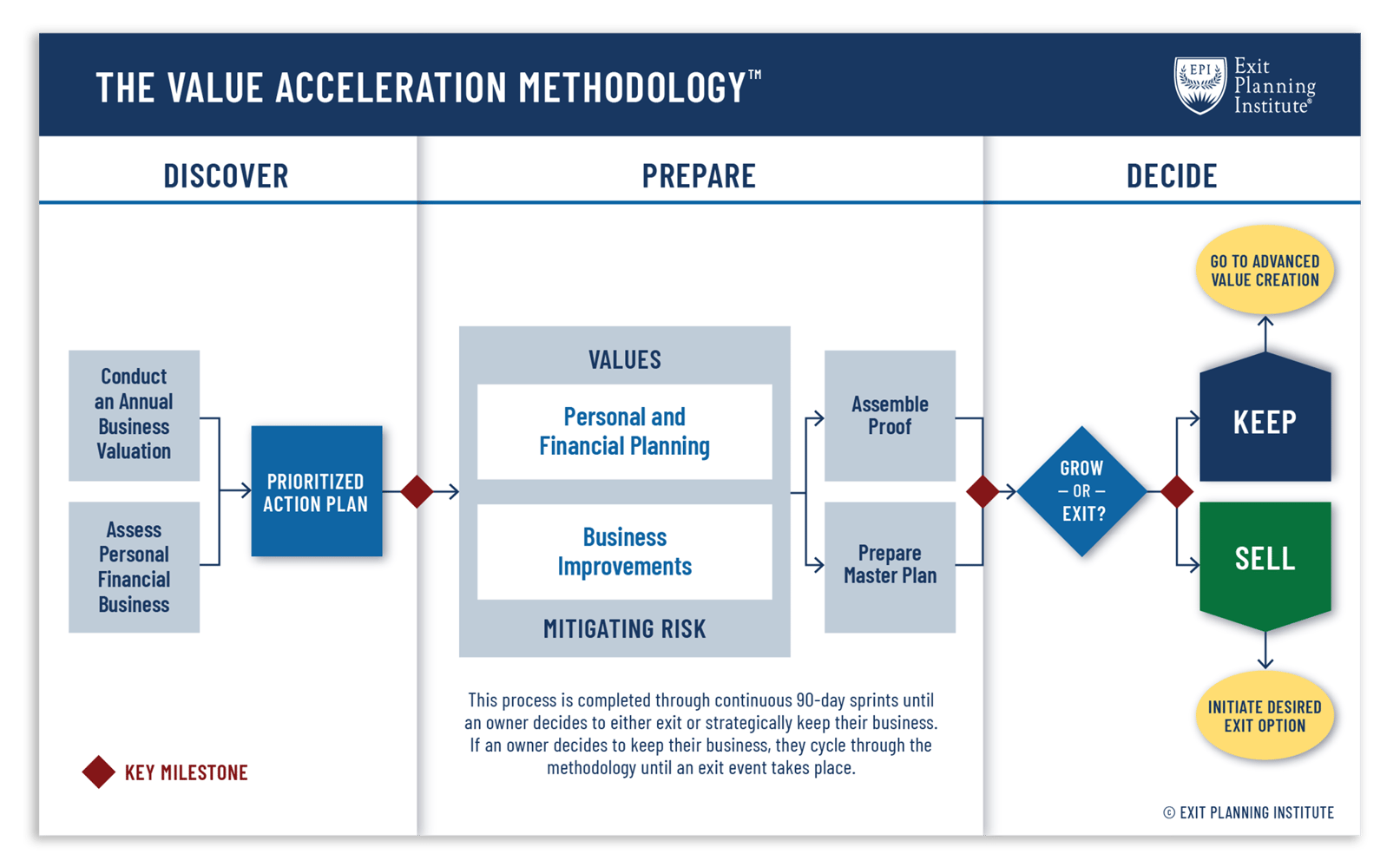

WHAT IS THE VALUE ACCELERATION METHODOLOGY™?

The Value Acceleration Methodology™ is your strategic framework for executing exit planning. Through the three-gate framework, a Certified Exit Planning Advisor (CEPA®) works with the business owner to navigate a comprehensive process of discovery, preparation, and decision-making. Value Acceleration is exit planning in action, focused on building transferable value today. It begins with assessing the business’s current worth, implementing proven strategies in focused 90-day sprints, and asking a critical question: Is it time to grow or exit? This approach, taught through the five-day CEPA® course, emphasizes what can be done now to increase business value and drive income. By building a company around the factors that create value and aligning the owner’s personal and financial goals in the process, owners gain the flexibility to exit on their own timeline and terms.

WHY IT MATTERS IN THE OWNER'S JOURNEY

The business owner’s most valuable asset is their business, and with 80% of their wealth tied up in it, they may not truly know its actual value. The Value Acceleration Methodology offers a clear view of the business's value and how to increase its transferable value over time. If an owner lacks alignment among the Three Legs of the Stool, which are their personal, financial, and business goals, the Value Acceleration Methodology empowers the owner and the CEPA to align these goals through actionable strategies, leading to a more fulfilling life overall and a significant exit.

WHAT IS EXIT PLANNING?

Exit planning is good business strategy.

Exit planning is a comprehensive strategy that combines planning, process, and execution to build a business that is transferable through strong Human, Structural, Customer, and Social capital. It creates value today while addressing the future of the business, the owner, and their family.

THE THREE GATES

The Methodology guides owners through three critical gates with their CEPA. First, they conduct a Business Valuation and Assessment of the personal, financial, and business value factors, creating the Triggering Event and the Prioritized Action Plan. In the Prepare gate, that plan is implemented in 90-day sprints to execute personal financial planning and business improvements on parallel paths with the advisory team, including a financial advisor and value advisor. Finally, in the Decide gate, the owner and the advisory team reach the pivotal moment to determine whether to move on to advanced value creation or move toward the exit.

DISCOVER

PREPARE

DECIDE

DIVE DEEPER INTO THE METHODOLOGY

Walking to Destiny is not only your essential resource to understand what makes your business attractive and ready for transition; it is a business owner’s handbook to know HOW TO rapidly grow value and ultimately unlock the personal wealth trapped in your most significant financial asset: Your Business. Walking to Destiny was written to arm business owners and their advisors with the knowledge and understanding needed to recognize their potential, execute growth tactics, and harvest the wealth locked inside a business.

CASE STUDIES

Read out latest case studies to see Value Acceleration in action from real-world CEPAs.

.webp)